Since building first began, the liability of those involved in it has been written into legal texts. One of the first codes of law was published in 1750 B.C. Even back then, Hammurabi’s Code referred to the liabilities of an “architect”.

In 2019, all construction companies must have an insurance policy, but beware; it is your responsibility as a client to check them. You can call on the services of a Project Management team to help you with this.

Methods Studio architects and builders are committed to having and offering

Construction insurance takes several forms to provide maximum protection against damage that may occur during and after work on a new construction or a renovation project.

The purpose of these insurance policies is that they can simplify matters and ensure the owner has acceptable and decent cover.

The legal obligations regarding insurance are also there to simplify matters for companies by requiring them to put in place more efficient After-Sales Service systems.

With a "turnkey" building project, whether for a new house, renovation or an extension, our team of Methods Studio architects and builders makes it his duty to have and to propose all the insurance necessary for the smooth running of works. And we require all contractors working with us to offer insurance monitoring.

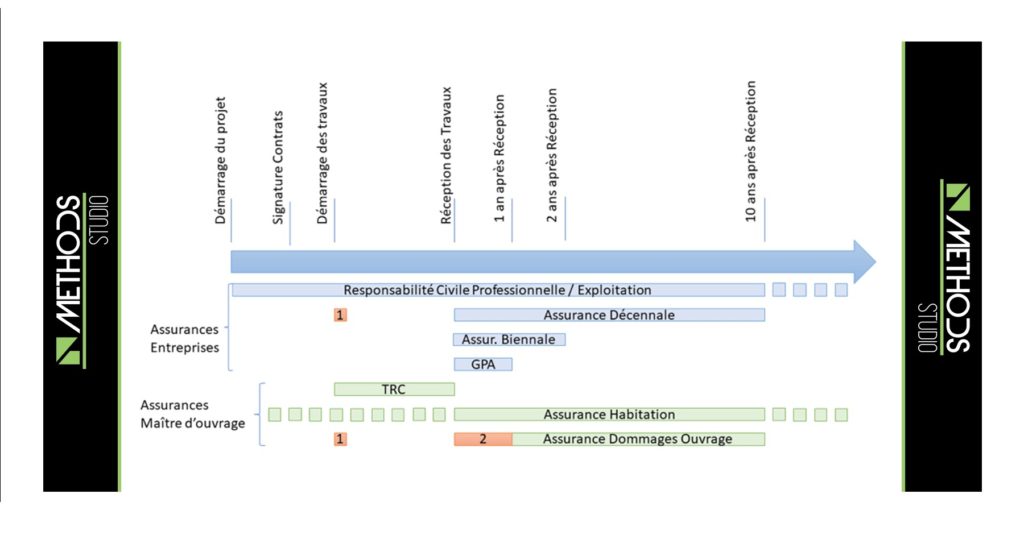

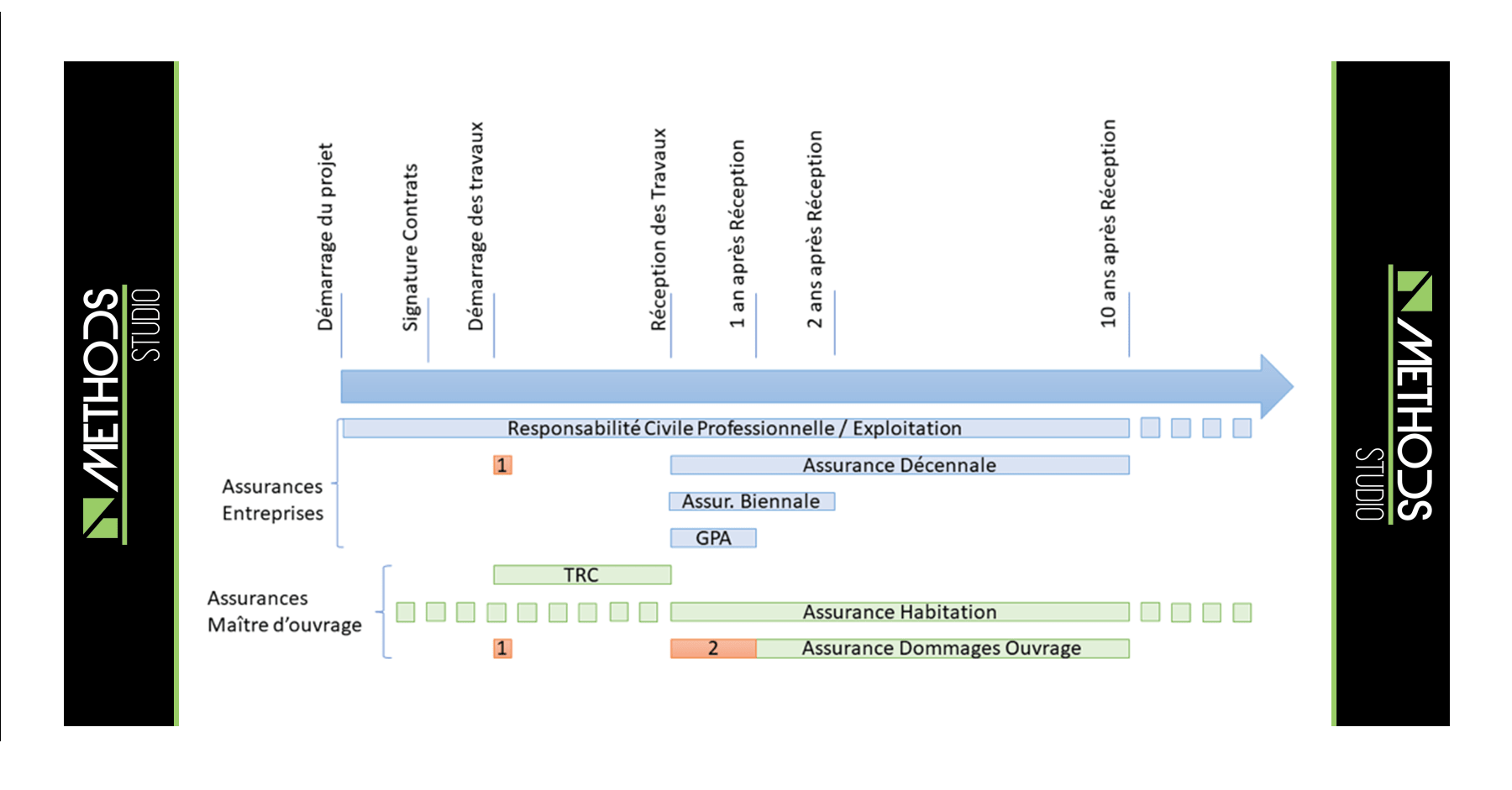

The duration of a project and related insurance

An outline of building work insurance

Note:

- Company and damage insurance must be taken out at the start of works.

- During the first year after Reception,the performance bond takes precedence over property damage insurance. Only failure by the company to intervene after formal notice has been served can trigger a property damage claim.

PB: Performance Bond

COC: Course of Construction insurance (all risks).

What should you check with a company’s insurance?

Before starting construction works, there are several steps to take. As seen in the diagram above, each step in the construction of a new house or a renovation is covered by its own insurance. It will therefore be necessary at each stage to ask your contractors about their insurance cover. In most cases they will provide you with proof of insurance.

Our team can give you some tips on deciphering these. First, you have to check that the policy has the correct name on it. It seems obvious but the policy must be in the Legal Name present on the company’s KBIS (the French corporation registry document). Then you need to check the year of the certificate. The certificate must be valid at the start of building work.

If the company is too new, you will need a nominative statement for your site provided by the latter's insurer.

After these first basic checks, you will have to check that the insurance on this certificate is indeed the correct one. It is not uncommon for companies to provide only Civil Liability and not the Ten-Year warranty However you also need the ten-year warranty insurance certificate. Do not hesitate to go directly to the insurer for more information if in doubt!

Lastly, as the Customer, observe the types of work covered by the insurance. Indeed, all companies are covered for all types of work.But the policy certificate defines the types of work covered by the insurance. If you have any questions, please be aware that your prime contractor can help you check insurance.

Included in turnkey contracts, Methods Studio architects and builders will make sure it obtains insurance confirmation for all contractors and works in collaboration with the structural damage insurance provider so that you do not have to worry about this.

What insurance cover does a company in France have to have?

- Professional liability insurance (including operating liability)

Taken out by all stakeholders such as the Project Manager, for example the architect or the design office, and contractors. This insurance protects the owners, that is to say you, the customer, in particular in the event of damage resulting from the work carried out and also in the event of damage caused during a visit to the home of the client.

Ten-year civil liability insurance

This insurance covers any construction work for a period of 10 years following the acceptance of such works. It covers damage affecting the solidity of the structure and elements forming an integral part of it for 10 years and elements not forming an integral part of it for two years (Biennial Insurance)

For example, a water leak in an embedded pipe occurs three years after you take possession of your house. You will make a claim under the 10-year warranty related to the building work. However, if a roller shutter breaks down after four years, it would come under the biennial warranty which has, by now, expired.

Watch out for problems appearing within the first year. In this event, the construction company is liable for the damage under the Performance Bond which runs for one year after receipt of works.

As an individual do you also have to take out insurance?

As an individual do you also have to take out insurance?

When building work begins, the customer (i.e. you, the person instigating the whole construction project) must take out Structural Damage Insurance (DO in French).

This insurance is mandatory for any natural or legal person in the role of owner of the project, or that person’s seller or agent. (Article L242-1 of the Insurance Code).

The DO covers the same damages as the 10-year warranty for companies. This is pre-financing insurance. Just for your information, the insurer has 90 days to process a claim using a single expert. The meter starts running on the day on which the claim is submitted to the insurer by recorded delivery letter with acknowledgment of receipt. In the absence of Structural Damage insurance, the experts of each party will protect their own interests and any claim could drag out over a period of anything from several months to several years.

This letter must contain: the policy number, the name and address of the owner, the date of receipt, a description of the problem, its nature, location, and importance.

Structural Damage and 10-year warranty insurance only run from the moment the work is delivered and accepted by you.This is why the “reception” is a crucial moment in a project.

Please note, any work outstanding after reception is called reservations. Reservations that have not been lifted, i.e. the work has not yet been carried out, are not covered by any warranty.

Furthermore, during the first year after receipt, all contractors are liable under The Perfect Completion Guarantee. In France, this bond is defined inArticle 1792-6 of the Civil Code.It covers damage that may occur during the year following receipt, aside from normal wear and tear of materials and their uses. The company is liable for this.

During construction work, the customer can take out additional insurance called Course of Construction insurance (All Risks).. This insurance protects the entire site from the moment work begins until completion and reception of the building.

This insurance covers the material damage that can occur during the project, in particular: fire, explosions, water damage, storms, natural phenomena, theft, and vandalism (depending on the conditions specific to each insurer). This insurance is not compulsory but protects the site and the owner from being short of funds when works resume after such an event.

Where does the Home Insurance taken out by the customer fit into all of this?

For a new construction, an insurance policy must be taken out as soon as the construction is weatherproofed. To put it simply, this is when the roof and windows are installed in your house.

For a renovation, home insurance must be obtained before the start of work. The existing construction must be covered by home insurance, and upon receipt of the work, the client must notify their home insurance company of the changes made to their property so the contract can be updated.

Certain damages related to improper use will not be covered by structural damage insurance but may be covered by home insurance. For example a bathtub which overflows because someone forgot to turn off the faucet.

In conclusion, if you are embarking on building work, do not hesitate to ask your architect firm for help in ensuring adequate home insurance.

All contractors in the construction trades must have insurance. You have to ask to see their policies because even if everything goes well during construction and the contractor is trustworthy, you do not know what the future holds!

It is also important to specify that insurance is not a guarantee of quality. Indeed, some companies have insurance and do not have the skills to carry out the work, and conversely, others have the skills but do not necessarily have up-to-date insurance.

As with all stages of construction, the Architect-Builder firm METHODS STUDIO offers you comprehensive support regarding insurance throughout your project. We can handle all the administrative management of our subcontractors to save you time and make things easier for you. (https://www.methods-studio.fr/construction-et-renovation-de-maison-a-paris/)

The main source we used in writing this article was the presentation made by Pascal Bouclier during a training session on October 10, 2018. The entire METHODS STUDIO ARCHITECTS team would like to thank Mr. Bouclier from the insurance firm Bouclier Assurance particularly for his involvement and follow-up.

The main source we used in writing this article was the presentation made by Pascal Bouclier during a training session on October 10, 2018. The entire METHODS STUDIO ARCHITECTS team would like to thank Mr. Bouclier from the insurance firm Bouclier Assurance particularly for his involvement and follow-up.

The Methods Studio team

Only when you are satisfied is our job done

follow us on LinkedIn

Contact our architect-builders: contact@methods-studio.fr